- UNI climbs above $6.90, ending a multi-week slump, with RSI at 56 and volume spiking.

- Daily active addresses hit 296, a three-month low, questioning the rally’s staying power.

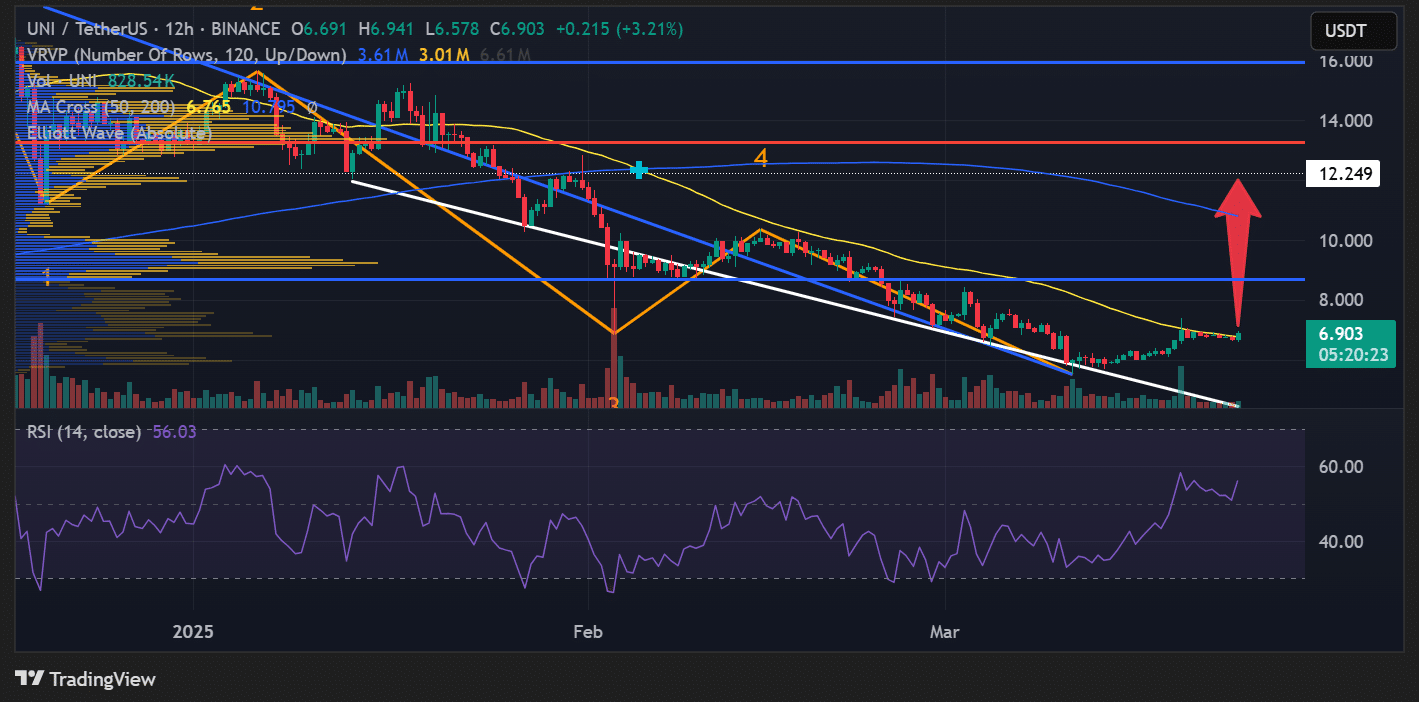

Uniswap’s token, UNI, has moved above a critical price level, ending a weeks-long downward trend. The token reached $6.90, posting a 3.21% gain in just 12 hours. This increase marks a clear break from a descending channel that had limited UNI’s price since early February, suggesting a possible change in direction for the cryptocurrency.

Technical indicators back this upward shift. The Relative Strength Index (RSI), which tracks price momentum, sits at 56.03. This number shows rising buying pressure, though the market has not entered overbought territory. Trading volume has also climbed sharply, a sign that often strengthens the case for a lasting price move.

Yet, not all data points align with this positive shift. According to Santiment, the number of daily active addresses on the Uniswap network has fallen to 296, the lowest in over three months. This drop in user activity raises questions about whether the price jump can hold. In cryptocurrency markets, price increases often depend on growing network use.

When more people engage with a platform, demand for its token typically rises. A decline in active addresses, however, hints that speculation—rather than increased usage—may be driving UNI’s current climb.

For UNI to keep rising, it must stay above $6.90 and target higher levels. The next resistance sits at $8.00, followed by $10.25, where the 200-day moving average rests. If user activity picks up, these levels could come into reach, supporting a stronger bullish outlook.

If active addresses keep falling, though, UNI may face trouble. The token could slip back to test support at $6.20. Price gains without network growth often lack the foundation needed for a prolonged rally.

For now, the breakout favors buyers. Still, the gap between price action and user participation leaves uncertainty. Traders should watch both market trends and on-chain data closely. A recovery in network use could solidify UNI’s advance, while continued declines might signal a retreat. The coming days will clarify the token’s path.

As of today, March 24, 2025, Uniswap (UNI) is trading at $6.975, showing a +4.29% increase on the day. The daily range fluctuated between $6.578 and $7.162, and the current volume is around 1.88 million UNI tokens.

Over the past week, UNI has seen a 13.60% gain, although it’s still down about 20% over the past month. Year to date, it’s experiencing a notable −47.35% decline, reflecting the broader pressure in the altcoin market.

Technical analysis suggests UNI is potentially forming a bullish reversal pattern — a falling wedge. The pattern is accompanied by increased volume and a recent breakout above a downtrend resistance, which may hint at the beginning of a larger bullish movement.

There’s speculation among analysts that if this breakout sustains, UNI could aim for targets around $10.00, representing an upside of over 40%. However, some caution remains, especially as broader market conditions and Ethereum’s trajectory will influence UNI’s mid-term direction due to its DeFi ecosystem ties.

Based on current price action, market structure, and volume behavior, my short-term price prediction for UNI is $7.48 within the next 3–5 trading days, assuming no major news or macro shifts affect crypto markets.

The post What’s Next for UNI? Traders Eye This Key Level appeared first on ETHNews.