- U.S.-China tariff cuts to 10% for 90 days may stabilize markets, boosting crypto and equities.

- Bitcoin’s $103K price reflects hedge demand; altcoins could rally as trade risks ease.

The U.S. and China agreed to reduce tariffs by 24% for 90 days starting May 14, signaling a temporary thaw in trade tensions. ETHNews analysts suggest the move could bolster risk assets, including cryptocurrencies and equities, as investors anticipate reduced economic friction.

Under the agreement, both nations will lower tariffs to 10%, down from prior levels. U.S. Treasury Secretary Scott Bessent stated the deal aims to prevent further economic separation, calling high tariffs “equivalent to an embargo.” The pause in escalation may stabilize global trade flows, creating a more predictable environment for investors.

“The consensus from both delegations is neither side wants to be decoupled,” Bessent said. “What has occurred with these very high tariffs was an equivalent of an embargo, and neither side wants that. We do want trade. We want more balance in trade.”

Aurelie Barthere, principal analyst at Nansen, notes Bitcoin’s recent resilience but predicts altcoins and equities could now catch up. “Bitcoin traded near all-time highs due to its insulation from tariff risks”. “With eased tensions, altcoins and the DXY index may rally.”

“I also expect the US dollar to perform strongly against prior safe-haven currencies such as the euro, Swiss franc and Japanese yen, reflecting improved global risk sentiment,” Barthere added.

Bitcoin’s price hovers around $104,000, buoyed by demand for assets perceived as hedges against macroeconomic risks. ETHNews analysts observe a bullish flag pattern on weekly charts, suggesting a potential rise to $150,000 if the structure holds. However, this hinges on sustained market confidence and follow-through from tariff developments.

Barthere adds that traditional safe-haven currencies like the euro and yen may weaken against the dollar, reflecting improved risk appetite. Nansen earlier estimated a 70% chance of crypto and equities bottoming by June, contingent on trade outcomes.

“This would need to go beyond merely extending the expiring tax cuts, and include additional income tax reductions as well as corporate tax cuts on top.”

Investors now eye potential U.S. tax cuts, hinted by Bessent for mid-July. Barthere argues that reductions beyond expiring provisions—including income and corporate taxes—could propel risk assets past January peaks. Such measures would inject liquidity, potentially accelerating capital flows into crypto markets.

Schiff argues deal resets trade war sans fixes; U.S. households face $1.3K tariff costs in 2025

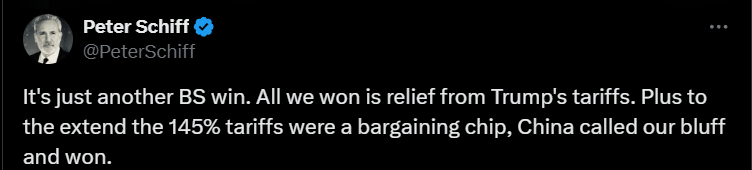

Economist Peter Schiff labeled the recent U.S.-China trade agreement a “BS win,” arguing that reduced tariffs favor Beijing over American households.

The White House announced a 90-day suspension of certain duties, lowering U.S. tariffs on Chinese goods to 30%, while China maintains 10% on American imports. Schiff contends the deal resets tensions without resolving core issues, leaving U.S. consumers bearing higher costs.

The “great” China trade deal simply pauses Trump’s trade war for 90 days. The only deal is both sides roll back their escalated tariffs. This means we’re in the same position we were before Liberation Day, except Americans are paying 30% tariffs while the Chinese are paying 10%.

— Peter Schiff (@PeterSchiff) May 12, 2025

The agreement pauses tariffs imposed since 2019, including those under Section 301 and 232, but retains pre-April 2025 levies. Data from the Peterson Institute shows average U.S. tariffs on Chinese exports reached 124.1% from 2019 to 2025.

The Tax Foundation estimates tariffs will cost U.S. households $1,300 in 2025, underscoring Schiff’s critique that Americans “harm themselves less for now” without long-term solutions.

Mixed Reactions and Economic Uncertainty

U.S. Trade Representative Jamieson Greer called the talks “positive,” citing potential to reduce the $1.2 trillion trade deficit. Treasury Secretary Scott Bessent described “substantial progress” while President Trump hailed “GREAT PROGRESS” on Truth Social. Schiff, however, predicts businesses will rush orders before the 30% tariff resumes, calling the pause a temporary reprieve.

China’s commerce diplomat Li Chenggang emphasized “win-win outcomes” but talks remain stalled on currency valuation and trade deficits. Future negotiations will address increased Chinese purchases of U.S. goods, echoing 2020 commitments. If no concessions emerge within 90 days, tariffs could revert, prolonging economic friction.

The post Why Altcoins Could Outshine BTC as U.S.-China Tariffs Take a 90-Day Breather appeared first on ETHNews.