- Chainlink (LINK) targets institutional investors with strategic tools despite facing ongoing network challenges and resistance.

- LINK price struggles to break the $12 barrier; analysts anticipate a breakthrough before the end of Q4.

Chainlink (LINK) has employed strategic measures to draw institutional investors, though the network itself faces ongoing challenges. Over the past two months, LINK has reached the $12 mark twice, encountering resistance each time.

Currently priced at $11.28, the main hurdle for LINK is to surpass this $12 resistance. Market analysts suggest that this breakthrough might occur before the end of the fourth quarter.

The general market optimism is partly fueled by Bitcoin’s recent test of the $62,000 resistance level, alongside the typical October market excitement. Additionally, other factors are contributing to investors’ confidence in LINK’s potential for value increase.

To strengthen its appeal to institutional investors, Chainlink Labs has formed a partnership with Taurus, a leading digital asset infrastructure provider. This alliance is intended to boost LINK’s transaction capabilities, which is essential for maintaining its competitive edge in the blockchain industry.

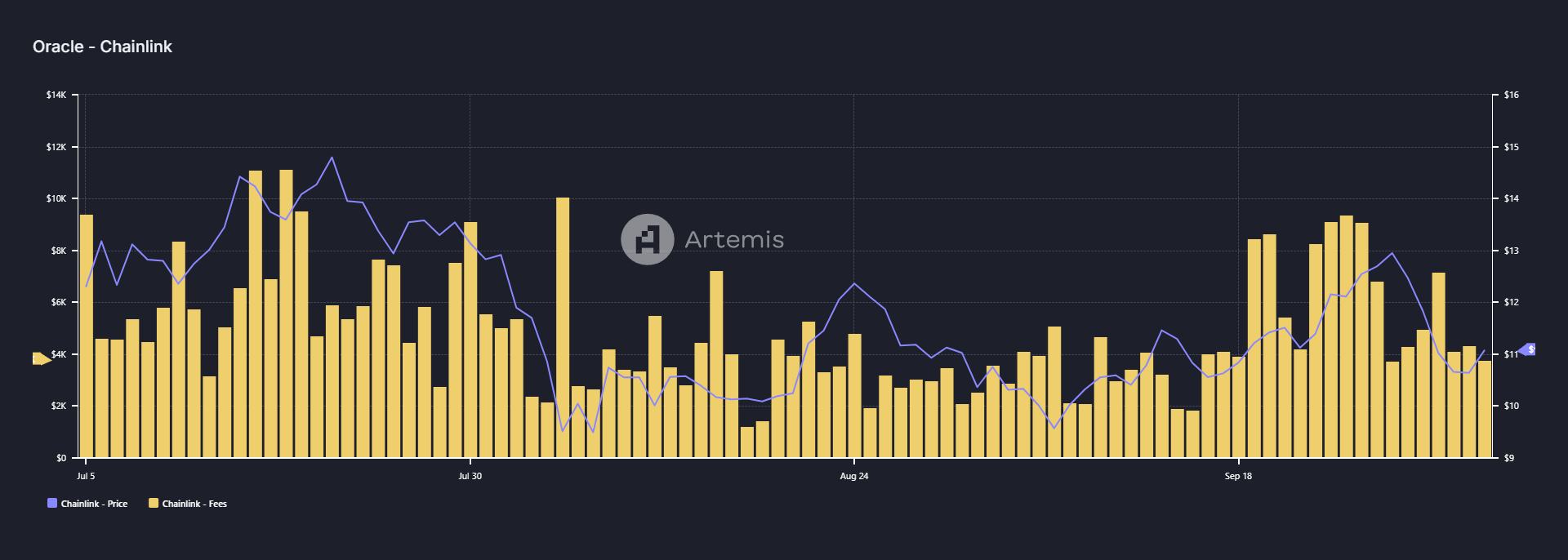

Despite these efforts, there are signs of concern. LINK’s decentralized finance (DeFi) platform has seen a decline in its total value locked (TVL), falling from $555 million to $484 million within a week.

Furthermore, daily transaction counts have decreased from a peak of one million in mid-July to a three-month low of 195,000 at the current count.

This period of internal struggle for LINK coincides with its strategic partnerships. If these initiatives are successful, they could position LINK for a potential price adjustment in the near term.

Another key factor influencing LINK’s price is the activity of whales, who currently possess 489 million LINK coins, accounting for 49% of the major stakeholders. Earlier in the month, these whales were selling off their holdings, but there has been a shift with an increase in accumulation in recent days.

![ChainLink [on Ethereum] (LINK) [18.19.01, 05 Oct, 2024]](https://www.ethnews.com/wp-content/uploads/2024/10/ChainLink-on-Ethereum-LINK-18.19.01-05-Oct-2024.png)

This renewed interest from whales has helped LINK convert the critical $10 resistance level into a support base. Achieving this milestone has made it plausible for LINK to overcome the $12 resistance soon.

However, the network’s internal issues, marked by a drop in user activity, cast doubt on speculative forecasts that LINK could reach $40 by the end of the next bull cycle.

The post Will LINK Smash Through the $12 Barrier? Analysts Say It’s Only a Matter of Time! appeared first on ETHNews.