- VeChain (VET) and VeThor (VTHO) have seen strong price increases, drawing attention from investors and market analysts alike.

- VET’s price surged over 28% in a week, while VTHO’s value rose 43% within just one day.

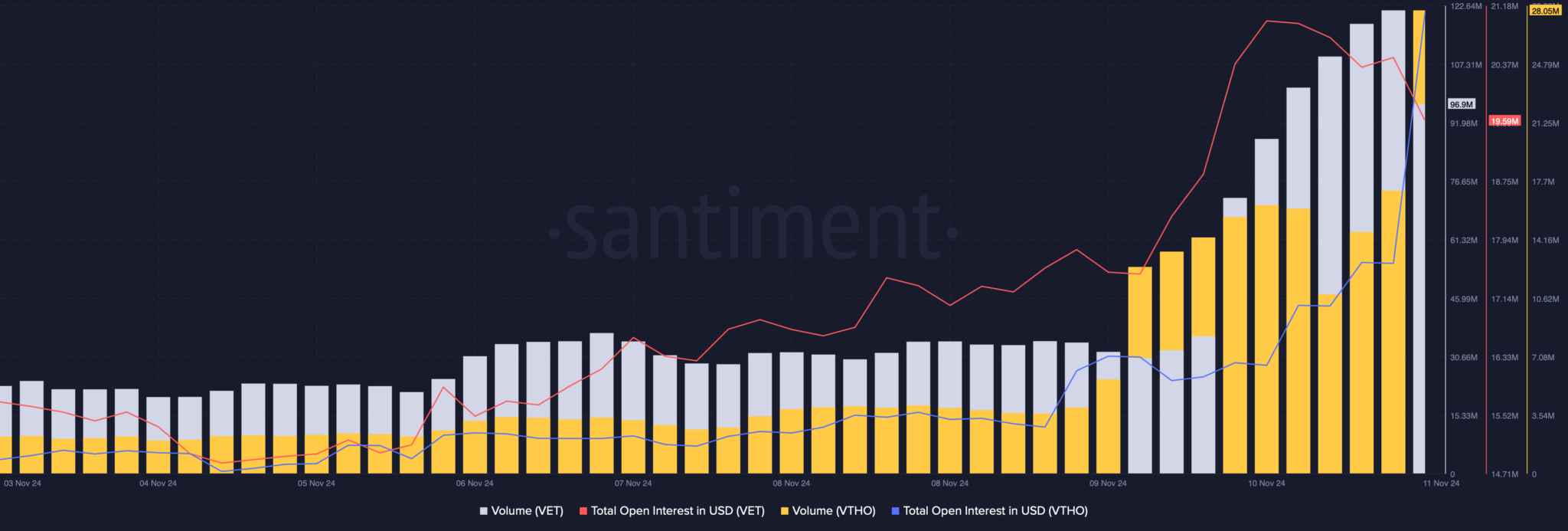

- Increased trading volumes for both tokens provide a potential base for continued growth in the near term.

VeChain (VET) and VeThor (VTHO) have drawn investor attention recently due to notable price increases. VET’s value rose by over 28% within a week, while VTHO experienced an impressive 43% surge in a single day.

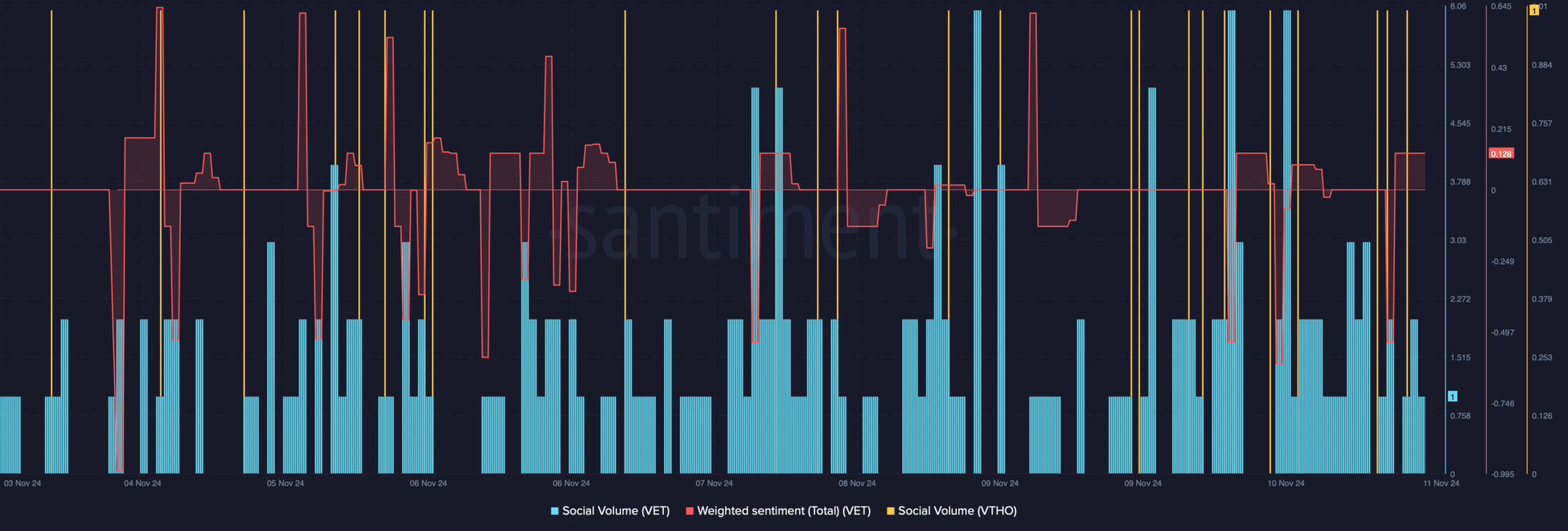

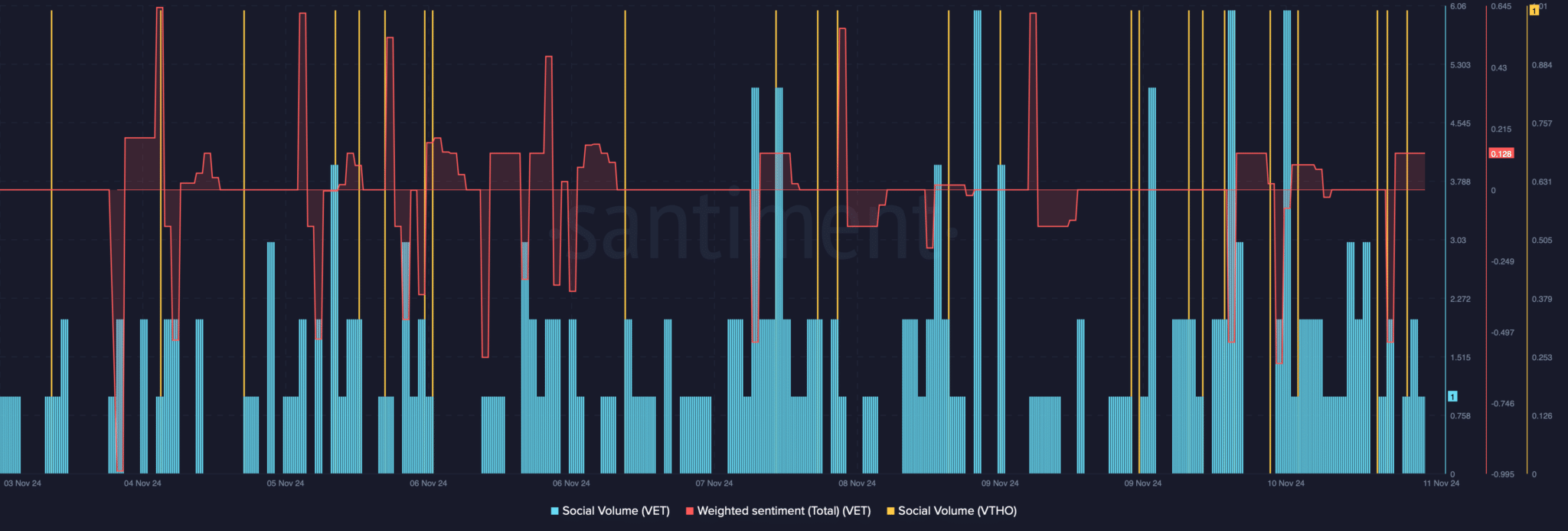

These gains, observed on ETHNews, have also influenced their social metrics, with both tokens witnessing a marked increase in social volume, indicating growing popularity. VET’s weighted sentiment showed a positive shift, signaling an increase in bullish sentiment around the token.

ETHNews analysis explored what could be expected for VET and VTHO based on their on-chain data. Both tokens saw higher trading volumes, which, when paired with price increases, is often viewed as a stable base for continued growth.

Additionally, Open Interest for both tokens rose, supporting the possibility that the upward trend could persist.

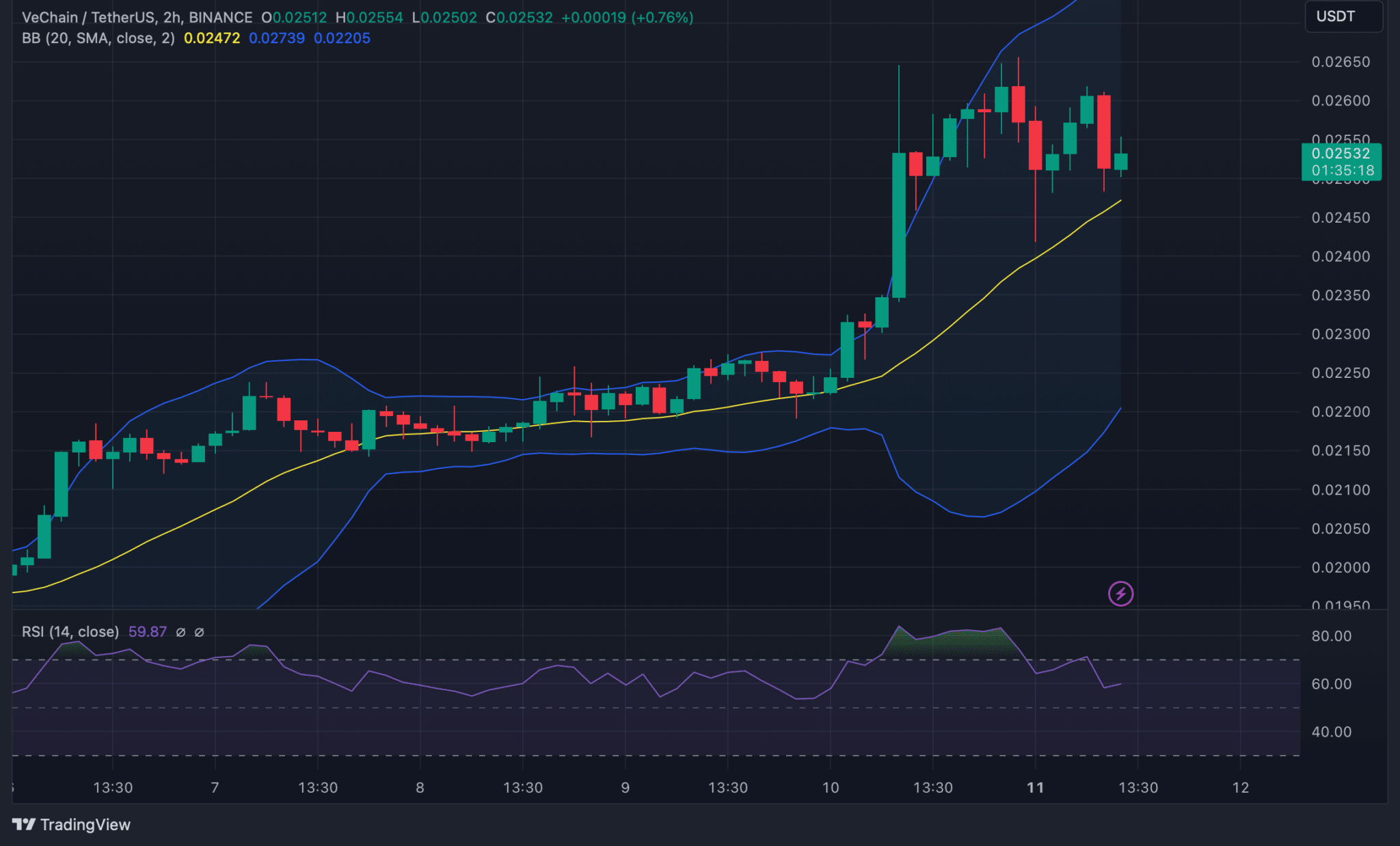

Technical indicators from TradingView suggested, however, that VET might face resistance in its growth. After touching the upper limit of the Bollinger Bands, the token experienced a slight pullback, and it was nearing its 20-day Simple Moving Average (SMA) support level.

VET’s Relative Strength Index (RSI) was also trending downward, indicating a potential price test of the SMA support in the short term.

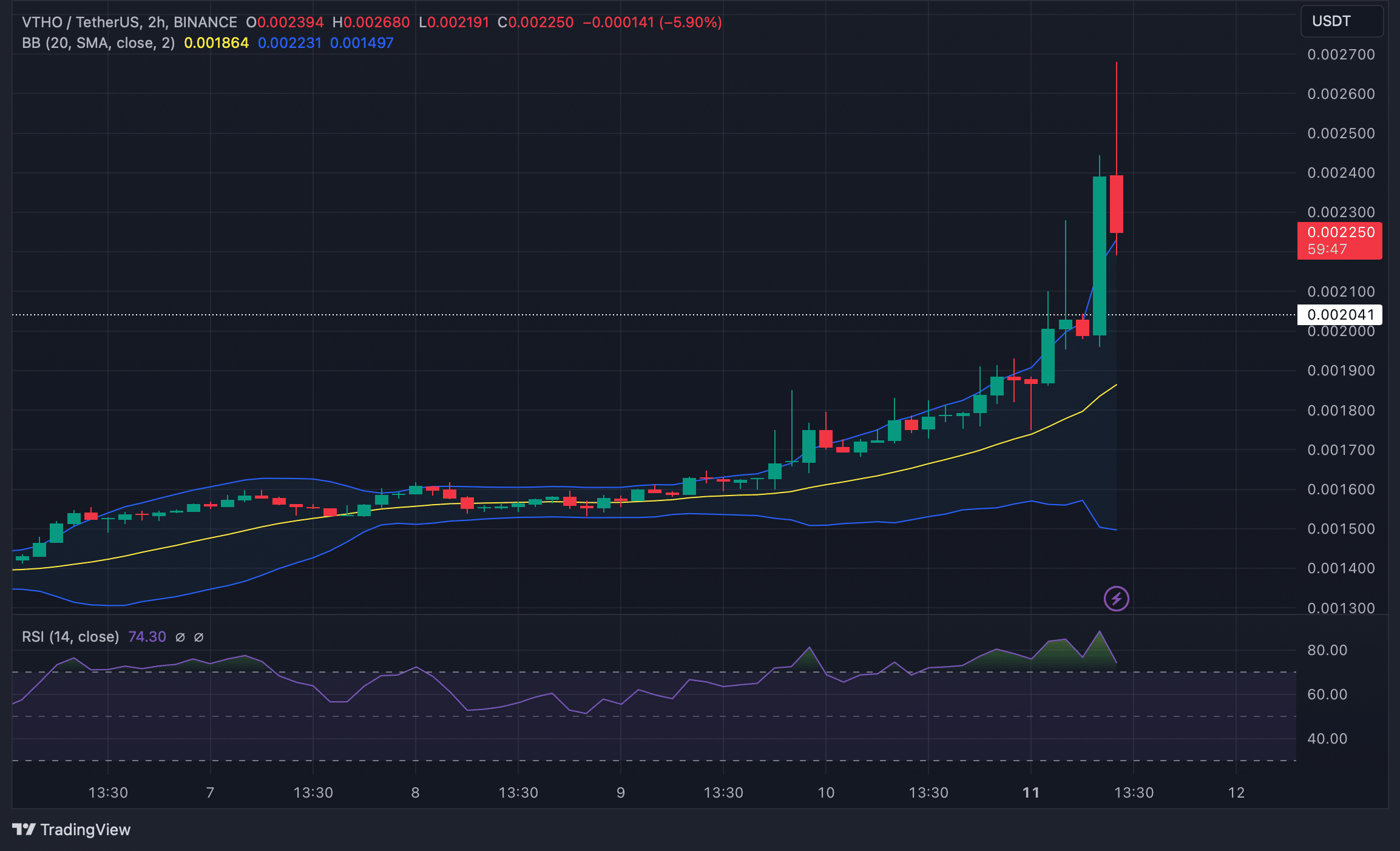

For VTHO, the recent rapid increase pushed its price above the upper Bollinger Bands limit. Its RSI entered the overbought zone, which typically signals that selling pressure could mount soon, possibly leading to a price correction.

Should this occur, VTHO’s value could approach its support level near $0.0020. These factors suggest that while both VET and VTHO have shown strong performance recently, investors should consider the possibility of corrections in the short term.

Traders monitoring these tokens might view the support levels to evaluate potential buying or selling opportunities.

For VET, stability near its SMA support could offer insights into its next moves, while VTHO’s reaction to selling pressures will likely determine whether its current price rally can be sustained.

Currently, the price of VeChain (VET) against Tether (USDT) is 0.02636 USDT, with a 4.15% increase in the last 24 hours. The recent price trend shows a 4.27% rise over the last day, an impressive 33.55% over the past week, and 16.72% over the past month, though it has declined by 20.85% in the past six months.

In technical analysis, VET appears to be at a support phase and seems to have broken out of its descending channel, which may indicate a continuation of bullish momentum if it manages to stabilize.

Some analysts suggest waiting for a consolidation or slight pullback before a stronger rally, with target levels around 0.03499 USDT and beyond, though this scenario may take time to fully develop.

The post Will VeChain and VeThor Continue Their Rally? Technical and Social Insights appeared first on ETHNews.