- XLM drops 1.67% to $0.28; death cross forms as 9-day DSMA crosses bearishly below 21-day DSMA.

- Derivatives volume crashes 62.7% to $97M; Open Interest dips 6.6% amid fading trader participation.

Stellar (XLM) has declined 1.67% in the past 24 hours, trading at $0.28 as bearish technical indicators and weakened derivatives activity pressure the asset. The drop follows a two-week high of $0.33, with losses accelerating alongside a 62.7% reduction in derivatives volume to $97 million.

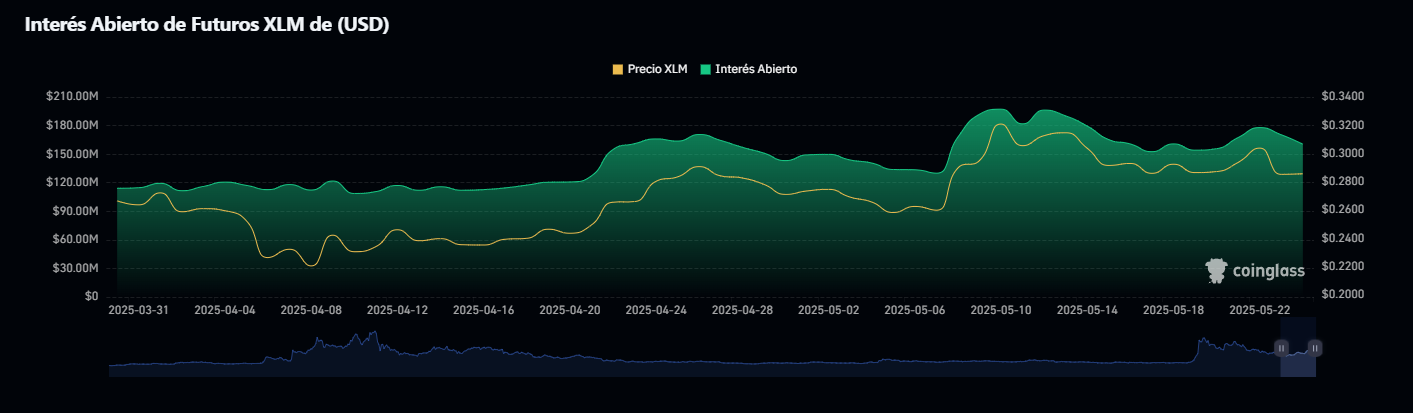

Open interest, reflecting active futures positions, fell 6.6% to $160 million—a sign of diminishing trader engagement.

A “death cross” formed on XLM’s daily chart as the 9-day simple moving average (DSMA) crossed below the 21-day DSMA. This pattern often signals short-term bearish momentum. Prices now hover below both moving averages, suggesting sustained downward pressure unless XLM reclaims $0.291.

#Stellar $XLM could be breaking out of an ascending channel, potentially targeting $0.26! pic.twitter.com/DLSOF4CQOe

— Ali (@ali_charts) May 24, 2025

Analyst Ali Martínez highlighted a potential breakdown from an ascending channel, a structure typically indicating trend exhaustion.

Spot market data reinforces the bearish outlook. Sellers outpaced buyers by 313,200 XLM tokens, creating negative delta—a metric tracking the imbalance between buy and sell orders. This imbalance points to persistent selling activity, with XLM’s next support level near $0.265.

The derivatives slump aligns with broader risk aversion in altcoins, as traders shift focus to Bitcoin amid volatile market conditions. For XLM to reverse course, bulls must secure a daily close above $0.29, a level that would neutralize the death cross’s bearish implications. Failure to hold current levels could see the asset test $0.26, a zone last visited in early May.

Stellar’s challenges mirror struggles across mid-cap cryptocurrencies, where liquidity constraints and technical headwinds dampen recovery efforts. While the network’s fundamentals—including its role in cross-border settlements—remain intact, price action reflects speculative forces rather than organic adoption.

Stellar (XLM) – Price & Technical Market Analysis – May 25, 2025

Stellar (XLM) is currently trading at $0.2796, marking a -3.04% decline over the past 24 hours and a -5.07% drop over the last 7 days, signaling a mild bearish trend in the short term. Despite this pullback, XLM remains up +152.2% year-over-year, showing that the asset continues to perform well on longer timeframes.

The token holds a market capitalization of $8.7 billion, supported by a circulating supply of 31.1 billion XLM, and a 24-hour trading volume of $164.67 million, though volume has dropped by nearly 20%, indicating reduced trading interest for now.

From a technical standpoint, XLM is trading in the range between $0.2792 and $0.2886. Key support lies near $0.275, and a breakdown below this could open the door to further downside toward $0.26–$0.24.

On the upside, a close above $0.29 would be needed to reignite momentum and potentially push toward the next resistance at $0.31–$0.33. Recent headlines suggest a potential “death cross” is forming, which could pressure bulls further in the near term.

Despite the recent downturn, community sentiment remains 86% bullish, driven by Stellar’s positioning in cross-border payments and interoperability. Strategic collaborations and technical improvements continue to make XLM a relevant contender in the Layer 1 market, even as it lags short-term compared to other smart contract platforms.

The post XLM Price Alert: Seller Dominance and Negative Delta Threaten Breakdown to $0.26 appeared first on ETHNews.