- XRP derivative markets experienced $220 million in withdrawals amid investor concerns over Paul Atkins’ nomination to the SEC.

- Atkins’ extensive crypto investments, including Anchorage Digital and Securitize, spark conflict-of-interest questions during Senate confirmation hearings.

XRP markets have experienced heavy withdrawals totaling approximately $220 million in recent days, driven by concerns around the nomination of Paul Atkins to SEC. Atkins, previously a commissioner from 2002 to 2008, has a record favoring lighter financial regulation, but his substantial personal crypto investments have raised questions among lawmakers.

Atkins holds between $2 million and $6 million in various cryptocurrency-linked companies. These holdings include Anchorage Digital, Securitize, and Off the Chain Capital, all prominent entities within the digital asset industry.

Senators, including Elizabeth Warren, have expressed concern over possible conflicts of interest due to Atkins’ past advisory roles for financial companies, particularly those involved in crypto activities.

During Atkins’ confirmation hearings, Senator Warren pointedly questioned whether his previous clients might benefit unfairly from his position if confirmed. Lawmakers remain cautious, worried that Atkins’ influence might lead to regulatory decisions favoring private crypto interests. Such apprehension has already influenced market confidence, particularly affecting XRP traders who closely watch the SEC’s stance on cryptocurrencies.

Traders currently fear that if Atkins’ nomination fails, a stricter SEC chair could take his place, potentially delaying approvals for crypto-based financial products like XRP ETFs. Ripple’s recent victory in its legal dispute with the SEC previously calmed the market, but new uncertainty surrounding Atkins has reignited investor anxiety.

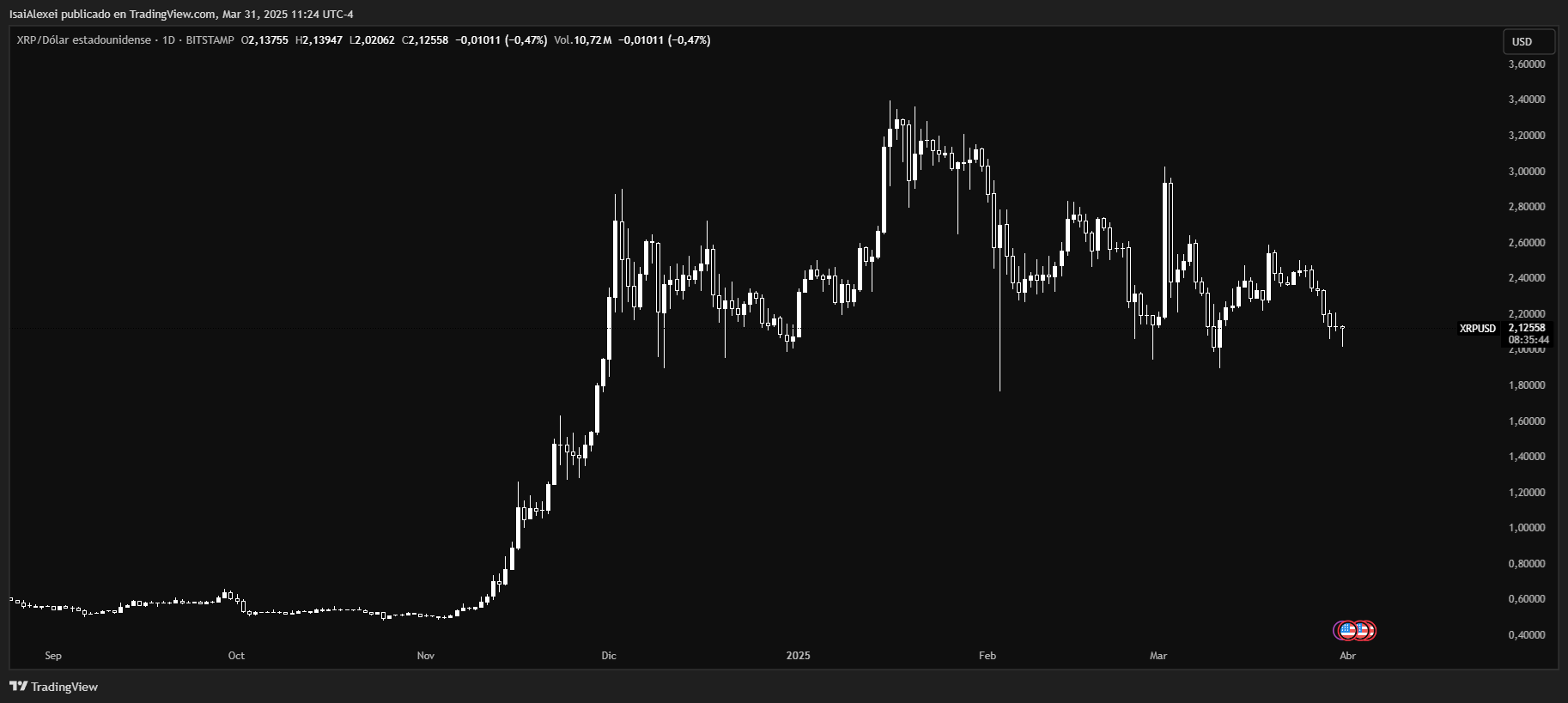

The immediate impact on XRP has been notable. XRP’s price recently tested support levels near $2.00, briefly dipping as low as $2.06 during heightened selling activity. Although XRP recovered slightly to $2.15, traders remain cautious, given the unresolved regulatory environment.

XRP investors have responded defensively by withdrawing significant funds from derivative markets. These withdrawals demonstrate growing investor hesitation as regulatory uncertainties persist. Until clarity returns, XRP markets may continue experiencing volatility, with traders cautiously awaiting regulatory signals.

As of Monday, March 31, 2025, the current live price of XRP (Ripple) is $2.1174 USDT, reflecting a +0.60% increase in the past 24 hours. However, over the last 7 days, XRP has dropped −9.46%, and its monthly performance shows a −2.35% decline. Despite recent corrections, XRP maintains a strong longer-term uptrend, with a +240.91% gain over the past year, making it one of the most resilient large-cap altcoins in the current market cycle.

Today’s technical analysis indicates a sell signal on the daily timeframe, while the weekly rating is neutral, and the monthly outlook is bullish. This mixed structure suggests short-term consolidation or weakness inside a broader bullish macro trend.

XRP’s current volatility is around 5.79%, showing that although it’s pulling back, it remains actively traded and responsive to news and volume shifts.

Price action shows that XRP is trying to hold above the key psychological support zone at $2.10. If this level holds, the next upside target lies at $2.30–$2.50, while a breakdown below $2.10 could lead to a deeper pullback toward $1.95–$1.85, areas where previous demand has been observed.

The post XRP Derivatives Face $220M Outflows Amid Atkins’ SEC Controversy appeared first on ETHNews.