- XRP Ledger integrates real-world assets (RWAs), automated market makers (AMMs), and oracles to enhance institutional DeFi.

- New developments focus on liquidity, compliance, and secure trading infrastructure for financial institutions.

The financial market is undergoing a shift as institutions search for blockchain for security and efficiency. The XRP Ledger (XRPL) is taking it a step further by incorporating real-world assets (RWAs), automated market makers (AMMs), and oracles, making it a secure platform for DeFi for large financial operations.

For institutional DeFi to scale, it needs compliance-ready, interoperable infrastructure: https://t.co/cOBE583aT0

The XRP Ledger delivers with:

AMM trading & onchain price oracles

Tokenized real-world assets (RWAs)

Decentralized identity (DID) for secure transactions…

— RippleX (@RippleXDev) February 25, 2025

Ripple announced these enhancements in a recent blog post, discussing ways in which these enhance XRPL as an institution-friendly solution for onboarding digital assets in a regulated market.

Its underlying decentralized exchange, ultra-fast settlements, and minimal transaction costs drive its DeFi play for institutions. With a transaction record of over 2.8 billion, its blockchain is being developed into a regulatory-friendly blockchain on which tokenized assets can be exchanged inexpensively.

Moreover, a CLOB and facilities for payment, such as an escrow and a settlement on a deferred basis, increase its capacity for processing financial-quality transactions.

According to our previous report, a key achievement is the launch of an AMM based on the XLS-30 standard, which allows liquidity providers to contribute to optimizing pricing in liquidity pools and on the book of orders. In contrast to traditional AMMs, XRPL is directly integrated into its DEX, which provides improved pricing execution.

Adding a clawback provision on selected assets facilitates regulatory compliance, which allows easier fund recovery in case of fraud or loss of access. The improvements make for a safer, more appealing platform for institution players.

How XRP Ledger’s DID and Oracles Strengthen Security

XRPL achieves institution financing via decentralized identity (DID) and pricing oracles. The XLS-40 standard enables financial institutions to issue verifiable identities in a non-intermediated process, preserving privacy-oriented KYC/AML requirements. This enhances regulated trading by allowing permissioned entry without compromising personal data.

Additionally, Oracles on Band Protocol and DIA deliver timely, accurate crypto and traditional asset pricing data. This reduces third-party dependency, supporting cross-chain trading, RWA pricing, and risk management for institutions. By inserting oracles directly in XRPL, the network facilitates secure, streamlined data flows for financial markets.

Future Developments: Lending, Compliance, and Programmability

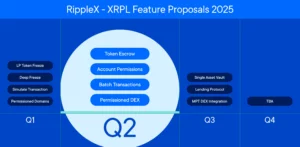

Looking ahead, XRP Ledger is set to incorporate more complex compliance solutions, lending functions, and programming functionality, which will expand its appeal among institutions.

Its new lending protocol, currently in validator review, will provide DeFi solutions based on credit, minimizing intermediation, improving liquidity, and transparency. The protocol, which is in validator review, will provide a secure mechanism for institutions to tokenize and securitize loans, which can be directly linked to stablecoins and real-world assets.

Additionally, a solution for more flexible, metadata-rich tokenization of financial securities such as bonds and structured securities, known as multi-purpose tokens (MPTs), is in development. MPTs represent a middle ground between non-fungible and fungible tokens, enabling an on-chain exact replication of real-world assets.

As we reported earlier, Programmability is another driver of growth, and XRP Ledger is about to release “Extensions,” a functionality for adding smart logic on top of native ledger functionality without a requirement for full smart contracts.

The post XRP Ledger Brings RWAs, AMMs & Oracles to Institutional DeFi—Here’s How appeared first on ETHNews.